Crypto market crash may have been the result of market manipulation

Early this early morning, crypto markets practically widely experienced a price drop at around 5 am UTC. Yesterday’s crypto market rally was damaged after the flash sale and also markets have actually somewhat recovered and also are now fairly supported.

Crypto Twitter is still capturing on, with just a few users experiencing complication about the situation.

How can the entire crypto market crash like that?

—– Sports Guy (@Jimbeamclassic) August 2, 2020

Looking for the ultimate passive income opportunity?

>> Learn how fortunes are being made every day

The markets collapsing generally at the same time can be equated to trading robots reacting to arbitrage trading possibilities throughout exchanges. The consistent drop throughout most preferred trading sets (in addition to stablecoins) leaves a great deal of room for analysis.

Allow me know what you believe by talking about the complying with tweet.

What do you think was the reason behind this morning” s global crypto market crash? #cryptonews #bitcoin #ethereum #therestofcrypto #defi

—– Zoran Spirkovski (@SpirkovskiZoran) August 2, 2020

There’s yet to be a genuine description, but taking a look at the graphes, only stablecoins experienced gains at the same time, a signal that a whale pumped the markets, prior to quickly heading for the leave door. So, allow’s consider the abnormality, i.e. stablecoins.

A peek at WhaleAlert, a twitter account that reports on big crypto activities, we discover an unusual phenomenon. Hours before the dump, around $52 mil USDT were transferred from Tether Treasury to Binance, and an additional $55 mil USDT was moved from the treasury to Huobi.

This was followed by an issuance of a new batch of $250 mil USDT, at the treasury.

💵 💵 💵 💵 💵 💵 💵 💵 💵 💵 250,000,000 #USDT (250,549,969 USD) minted at Tether Treasury

— Whale Alert (@whale_alert) August 1, 2020

Find the rest of the WhaleAlert tweets at the end of the article.

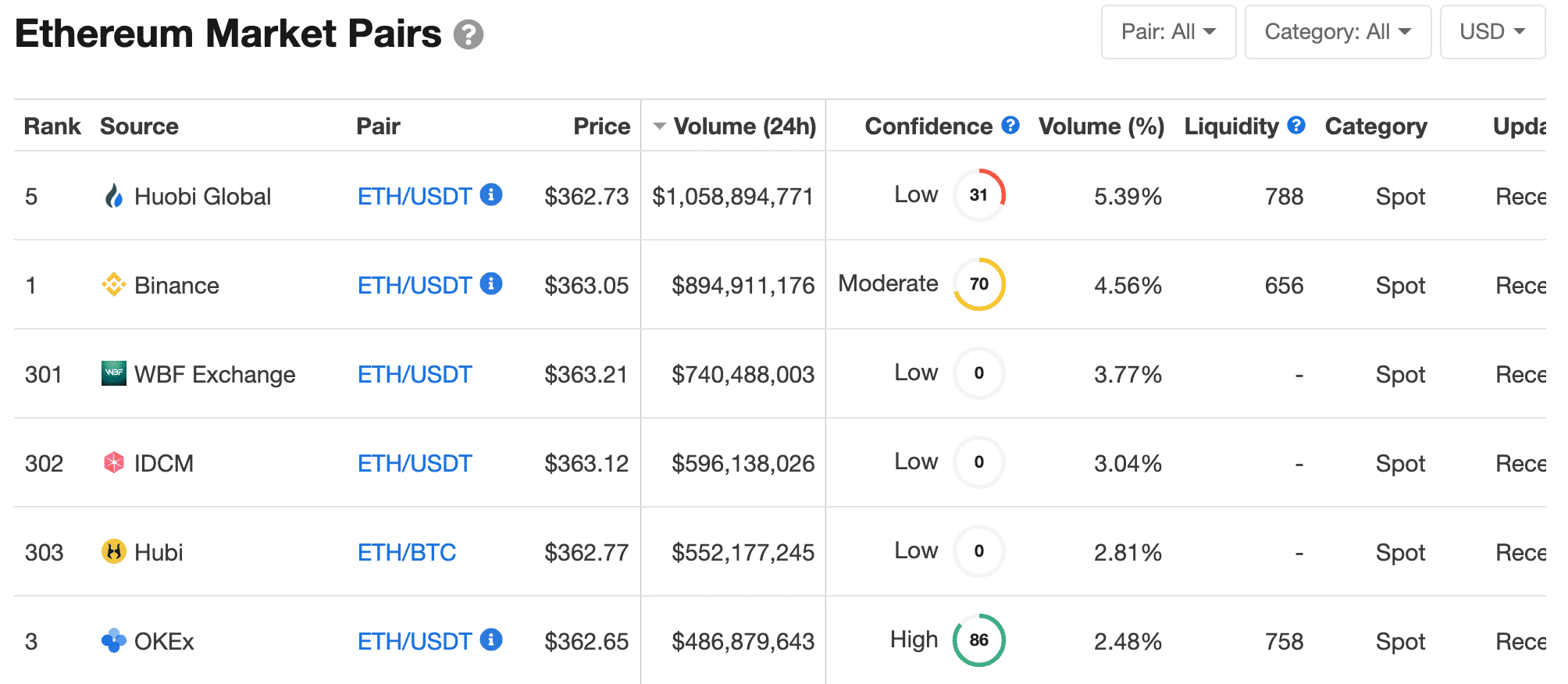

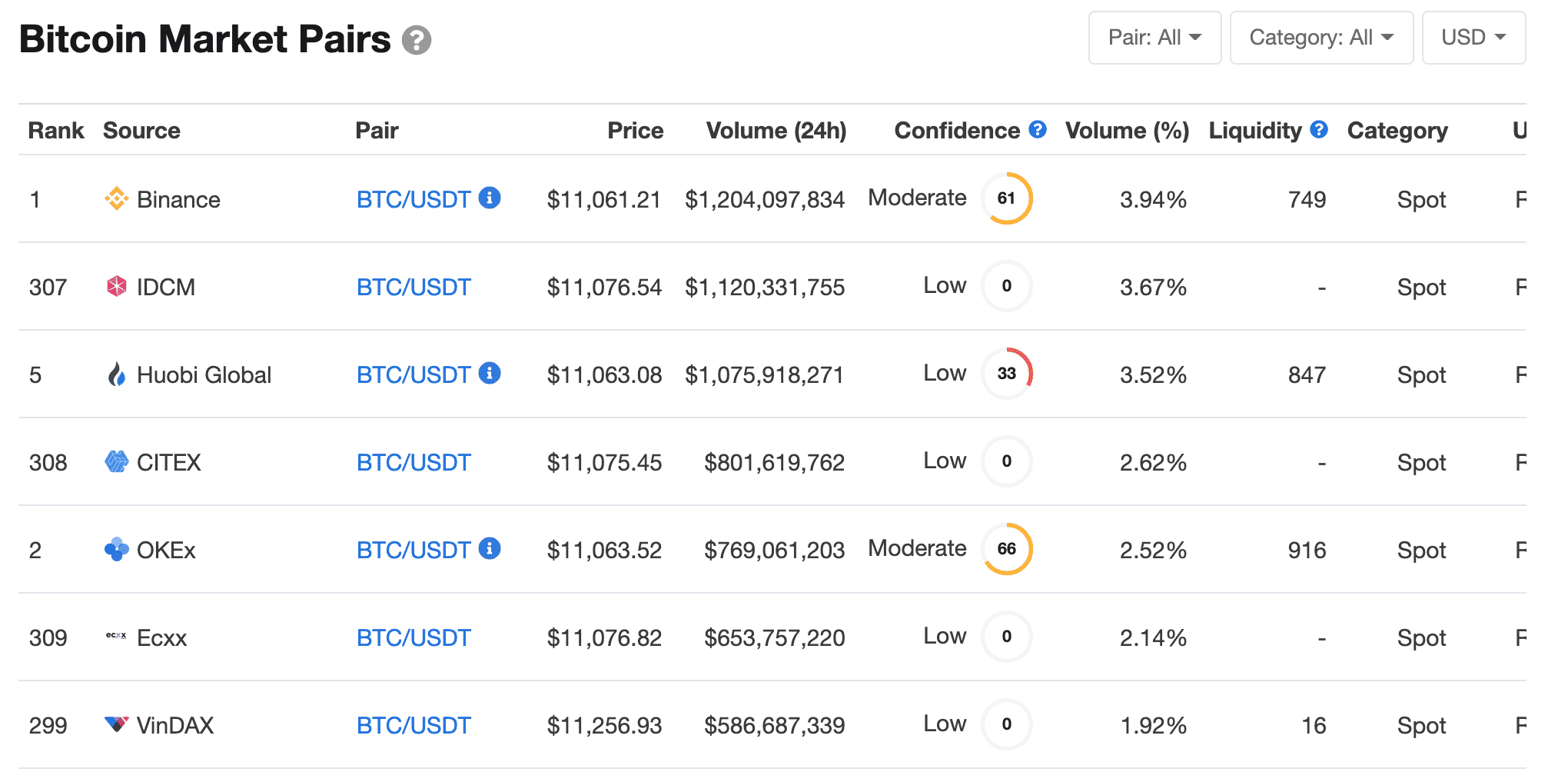

Easily both Binance and Huobi are the exchanges that experienced the greatest degrees of USDT-related quantity in the past 24 hours, showcasing them as the major cost driver behind the activity.

Was there bad deed as well as market adjustment behind the rally and succeeding dump, or was this just a possibility taken by a profit-hungry whale?

Was there bad deed as well as market adjustment behind the rally and succeeding dump, or was this just a possibility taken by a profit-hungry whale?

While there are tips aiming at an unholy collaboration in between iFinex (Tether), Binance, and Huobi in an initiative to draw out profits, there is no substantial evidence on which we can make this insurance claim.

Binance Tweets

🚨 18,300,000 #USDT (18,144,352 USD) transferred from Tether Treasury to #Binance

— Whale Alert (@whale_alert) August 1, 2020

🚨 18,800,000 #USDT (18,884,461 USD) transferred from Tether Treasury to #Binance

— Whale Alert (@whale_alert) August 1, 2020

🚨 16,400,000 #USDT (16,358,524 USD) transferred from Tether Treasury to #Binance

— Whale Alert (@whale_alert) August 1, 2020

Huobi Tweets

🚨 🚨 25,000,000 #USDT (25,173,750 USD) transferred from Tether Treasury to #Huobi

— Whale Alert (@whale_alert) August 1, 2020

🚨 🚨 🚨 30,000,000 #USDT (30,031,581 USD) transferred from Tether Treasury to #Huobi

— Whale Alert (@whale_alert) August 1, 2020